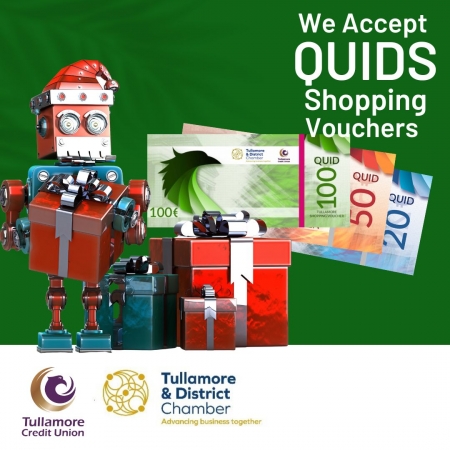

QUIDs Shopping Vouchers

QUIDS SHOPPING VOUCHERS

What are QUIDs?

From grocery stores to fashion shops, hotels and restaurants, home heating fuel and to golf-clubs, QUIDs are shopping vouchers that can be spent in participating business across Tullamore. This also includes locally-owned shops and businesses and national retailers like Tesco, Centra, Woodies, Argos and more, see list on website and others may accept them as well, just ask.

Small Benefit Exemption Scheme

Under the Small Benefit Exemption Scheme, employers can give QUIDs in 1 or 2 gifts up to a maximum of €1000 per employee in total as one-off benefit in a tax year without incurring liability for Income Tax, USC or PRSI (Employers or employee).

Local employers have driven the success of QUIDs since their introduction in several years ago. We would hugely welcome your support for this scheme. Company directors/small business owners – rewards yourself too!

No Fees or Commissions

There are no commissions, fees, no charges whatsoever to businesses purchasing or redeeming QUIDs.

Reward Your Staff with up-to €1000 Tax-Free in QUID shopping vouchers.

Introduced in 2008, by Tullamore Chamber of Commerce and Tullamore Credit Union the QUIDs scheme allows employers to exploit Revenue’s Small Benefit Exemption Scheme to reward their staff tax free.

OVER €170,000 vouchers sold in 2021, and from introduction to date, QUIDs to the value of over €1 million have been purchased by local employers to reward their staff, helping us to promote and protect local employment.